Growth and Cycles

Extends the Schumpeterian framework by introducing endogenous market structure through technology imitation. Rather than assuming creative destruction leads to monopoly replacement, the model allows incumbents to engage in 'imitation effort' to copy radical innovations and remain competitive. This modification creates more realistic firm survival dynamics and explores how market concentration affects innovation incentives. The framework bridges standard growth models with more flexible market structures where both innovation and imitation drive technological progress.

Project Resources

Key Findings

Incumbents can survive through imitation: Unlike standard Schumpeterian models where entrants replace incumbents, successful imitation allows established firms to remain competitive alongside innovators

Endogenous market structure emerges: The number of firms per sector becomes endogenous, determined by the relative success of innovation versus imitation efforts

Extended firm lifetimes: Both innovation and imitation mechanisms create longer average firm survival compared to pure creative destruction models

Modified Arrow replacement effect: When incumbents can imitate rather than being displaced, the traditional replacement effect may not hold, allowing both entrants and incumbents to invest in technological progress

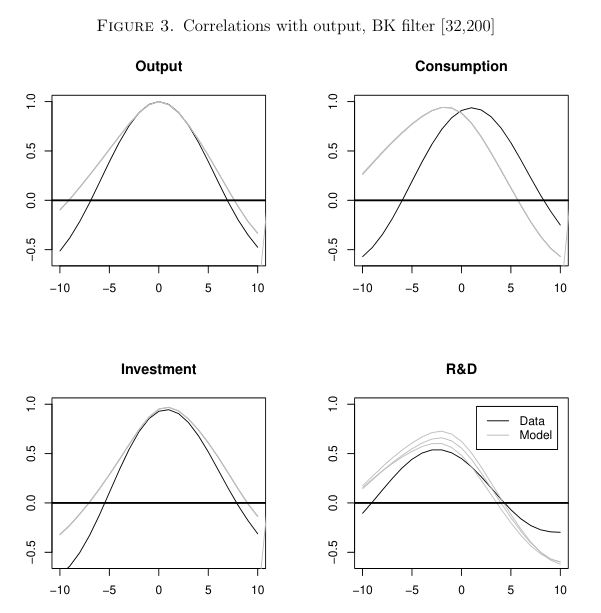

Model successfully replicates the asymmetric correlation structure showing R&D leading output by several periods, with stronger correlations at negative lags than positive lags.

Methodology

Extended quality ladder model: Builds on standard Schumpeterian growth framework but allows multiple firms per sector through successful imitation

Dual innovation processes: Entrants engage in radical innovation while incumbents can attempt to copy new technologies through imitation effort

Endogenous firm dynamics: Market structure evolves based on success rates of innovation and imitation, creating realistic industry concentration patterns

Competitive equilibrium with multiple firms: When imitation succeeds, profits are shared among the original innovator and successful imitators

Dynamic general equilibrium: Integrates innovation and imitation decisions with standard RBC framework for business cycle analysis

Implications

Competition policy: Regulators must distinguish between concentration arising from superior innovation versus that resulting from legitimate imitation and learning

Innovation incentives: Both breakthrough innovation and rapid imitation contribute to technological progress and economic growth

Industry evolution: Model explains realistic patterns of firm turnover and market concentration across different sectors

Firm strategy: Companies face strategic choices between pioneering new technologies versus quickly adopting and improving existing innovations

Growth theory: Technological progress stems from both creative destruction and incremental improvements through competitive imitation